SITREP First half of 2023

A lot has happened over the first six months of 2023. We have seen banking failures, the subsequent take over of regional banks by JP Morgan and Jamie Dimon assuring his investors of the soundness of the financial system. We have also seen the yield curve invert like never before, as well as the crash of natural gas prices to historic lows. This comes to absolutely no ones surprise considering the Fed has hiked interest rates to 5.25%. A rate that is just high enough to cause recession fears and asset deflation, but not high enough to bring real rates into positive territory and get inflation down to the official 2% over the medium term.

In the geopolitical arena we have seen ever increasing escalations in the Russo-Ukrainian conflict. From the delivery of British Storm Shadow missiles to the supply of German Leopard 2A6 main battle tanks. We have also witnessed the deterioration of Sino-American relations over the balloon saga, after which the Chinese practically stopped speaking to the Americans. Furthermore we observed European leaders Macron and Von der Leyen's attempts to ensure the Chinese that "de-risking" does not mean the same as "decoupling" and to impress upon the Chinese leadership that Europe still has some sense of strategic autonomy. This last point being made mere days after the European Council on Foreign Relations released it's policy paper on the vassalisation of Europe by it's Anglo-American partners.

Meanwhile in the global south, 13 countries have applied to join BRICS+, including Saudi Arabia and Iran which have recently become friends, as well as Indonesia and Nigeria which add another half billion people to the alliance. There have even been rumors that NATO members Türkiye and France have expressed interest in joining the alliance. Unsurprisingly after BRICS+'s surpassing of the G7 in both population and GDP (as measured in PPP), even Foreign Policy admits that the era of global dollar dominance may be coming to an end. So how does all of this fit together and what does it all mean?

The macro picture during the first half of 2023

Firstly let's take a look at interest rates. The Fed's discount window rate is held within the 5.00% - 5.25% range. Since the beginning of 2023, the Fed has been raising rates more slowly at around 0.25% after each FOMC meeting. The market seems to be convinced that this is going to cause a recession that will be severe enough to put the inflation genie back into the bottle. The market then prices in lower rates for longer (which is visible in the yield curve inversion) and a return to the good times of before September 2019.

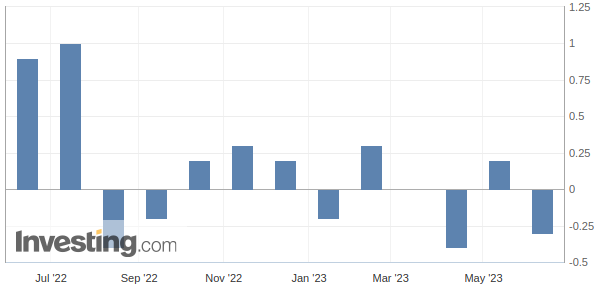

As you can see the yield curve took a dive at around this time in 2022 when the market started pricing in a recession. At the same time the YoY CPI started falling due to the base effects but prices did not start to come down.

Base effects are a phenomenon of year on year comparisons. When a cookie costs $1 in year 1, and $2 in year 2, we're talking about 100% inflation. When the cookie costs $3 in year 3, inflation comes down to 50% during the third year. Even though prices have risen 200% in 2 years time, the base effect make inflation appear to come down during the second year, whilst in reality prices are still rising at the same pace.

In the face of the inflation of 2022, the US government never slowed down spending. It has spent money on welfare, support to Ukraine, the inflation reduction act, the CHIPS act and many other inflationary policies. In order to prevent a panic from ensuing, the Fed has to balance between recession and "sticky inflation" narratives. On the back-end the G7 would work on an oil price cap and manipulate energy prices as to keep the headline CPI down, while Biden was doing his part by dumping tens of millions of barrels of SPR oil. The hope was that inflation would eventually run it's course and the Fed could lower rates again to bring debt servicing costs back to a manageable level.

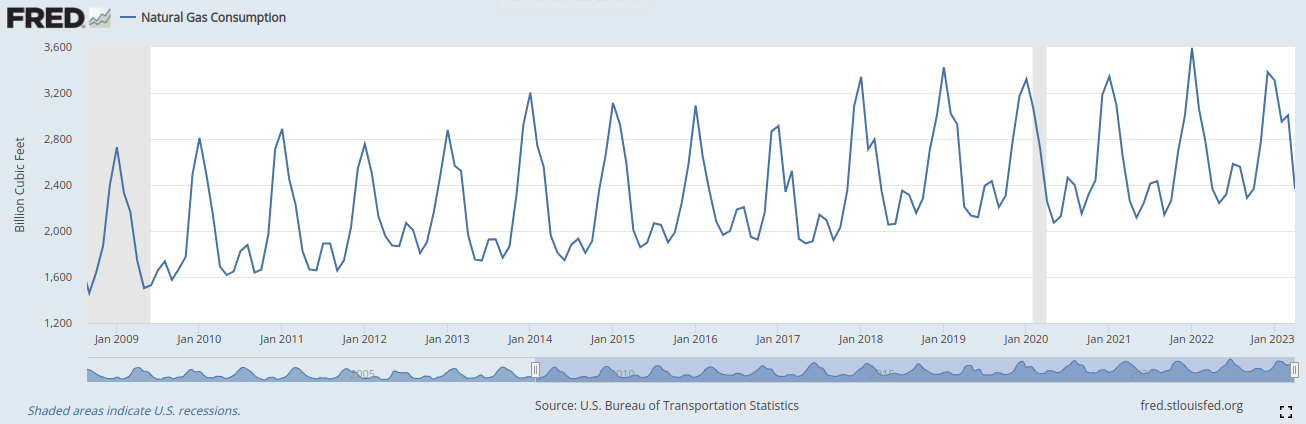

All was well until China threw a wrench in that plan with a well-timed reopening of the economy. Now we see energy demand at all-time highs and with the decreased output caused by artificially lowered energy prices, inflation is set to make a comeback in the second half of 2023 and the first half of 2024. Meanwhile the US treasury has prepared a bond buyback program in case the Fed has to stay higher for longer, which will cause borrowing costs for the US government to go down but not for the private sector.

Inflation to rear it's ugly head

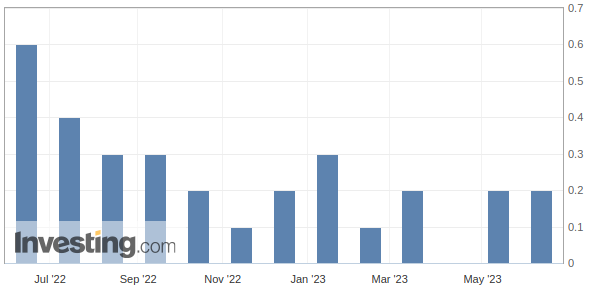

As you can see from the graphs above, the headline CPI came down during the summer of 2022. This was mainly due to base effects, recession fears and energy prices going down.

The base effects are going away by it's own. During the second half of this year the base effects will reverse and inflation will look higher than it actually is. The dreaded inflation killing recession is not going to happen for three reasons:

- The US government never stopped or even lowered deficit spending.

- Even if rates would be held higher for longer, the treasury would simply lower it's own debt servicing costs using the bond buyback program and continue to spend money.

- During the kind of great power competition the US finds itself in, it can't afford a depression or even deep recession. The easy alternative that governments facing this scenario have always chosen, is to print their way out of debt rather than defaulting the "honest" way.

Lastly the energy picture looks more bullish than it has looked in a long time. Natural gas three month futures prices have declined to historic lows while the US (the world's largest natural gas consumer) is consuming natural gas well within trend and actually hitting a record high during 2022.

Other commodity prices like oil are also set to rise. After OPEC's repeated warnings that they needed higher energy prices for longer in order to beak even, and Biden's continued dumping of the SPR, they are cutting production. According to the Energy Information Administration this will result in higher oil prices, especially at the end of 2023 and throughout 2024.

Then there's the elephant in the room

When Joe Biden and his European allies unleashed the "sanctions from hell" and took Russia's foreign exchange reserves following the Invasion of Ukraine in February 2022, he really put the nail in the coffin of global dollar dominance. The slow de-dollarization that had been taking place was put into gear and has accelerated to the fastest pace yet. With the sudden repricing of counter party risk, the world quickly started to "de-risk" their foreign exchange reserves. This is not just happening in the global south but in Europe as well. With all these dollars flooding back into the US and with inflation from government spending still in the pipeline, prices will surely continue to rise for longer. With economic activity on the decline and disappointing PMI's the stage is set for a period of stagflation.

In conclusion we should be set to make all the money once commodities return to their fundamental price range. That is of course if the latest plot, by an unnamed British intelligence service to push us into world war 3, turning our soon-to-be vacation homes into irradiated parking lots, does not succeed.

Comments ()